It isn’t entirely suitable for tracking your daily ten-buck purchases (though it’s okay) but is more appropriate for long-term forecasts. What Is a Budget Template and Is It for You?Ī budget template is a document file that you use to track your spending and income, as well as plan your finances. Does Google Sheets Have a Budget Template? What Should a Good Budget Template Have?.Household Budgeting Template for Families Google Spreadsheet Budget Template for Students Simple Business Google Sheets Budget Template Zero-based Budgeting Template Google Sheets 4 Best Free Google Sheets Budget Templates for Better Finances.

What Is a Budget Template and Is It for You?.Weve walked you through each step of the process, from setting up your budget to tracking your spending.

GOOGLE SHEETS FREE BUDGET TEMPLATE HOW TO

In this article, weve shown you how to make a budget in Google Sheets. There are many different ways to make a budget, but using a spreadsheet is a great option. A budget can help you track your spending, save money, and make better financial decisions. ConclusionĬreating a budget is an important step in getting your finances in order. Youll need to revisit your budget regularly to make sure its still accurate. Making adjustments to your budget is an ongoing process. You can also make adjustments if your income changes or if your expenses change. This step is important because it allows you to make changes to your budget based on your actual spending.įor example, if you find that youre spending more on groceries than you had budgeted, you can adjust your budget accordingly. The final step in creating your budget is to make adjustments. This can make it easier to see where youre spending your money. If youre manually tracking your spending, youll need to enter your expenses in the budget template each month.īudgeting apps can be helpful because they automatically track your spending and categorize your transactions. You can use a budgeting app, such as Mint or YNAB, or you can manually track your spending in a spreadsheet. There are many ways to track your spending. This step is important because it allows you to see how much money youre actually spending each month. The fourth step in creating your budget is to track your spending. This includes things like credit card payments, student loan payments, and any other debts you have. These are expenses that can vary from month to month, such as groceries, gas, and entertainment.įinally, add up your debt payments. These are expenses that you have each month and that dont change much from month to month. Start by adding up all of your fixed expenses, such as your rent or mortgage, car payment, and insurance. Make sure to include all of your income sources in your budget. It can also include things like interest income, dividends, and other sources of money.

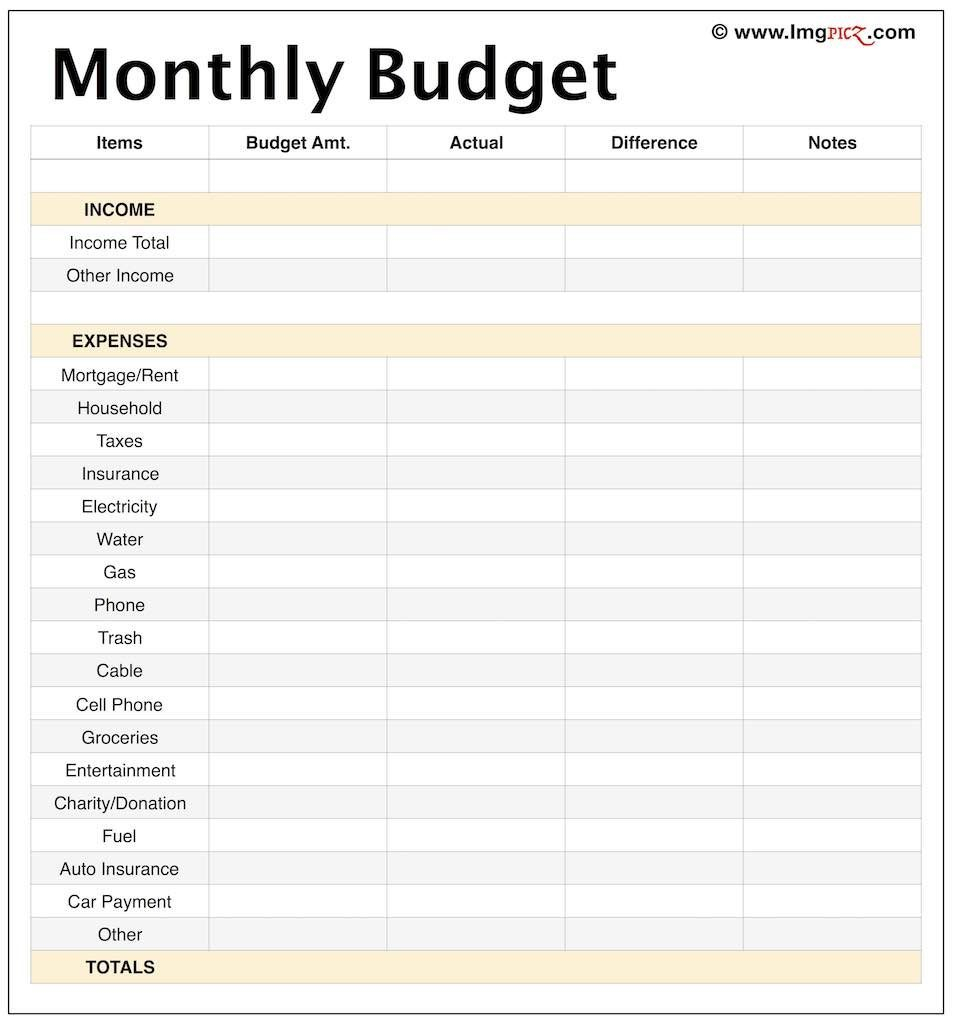

If you have more than one source of income, you can add a row for each source. Enter your monthly income in this section. In the budget template, youll see a section for income. Each category has a budgeted amount and a column for your actual expenses.

Youll see a sheet with different categories, such as housing, food, and transportation. Once youve found a budget template that you like, open it in Google Sheets. You can also find budget templates in Google Sheets by going to File > New > From Template. If youre not sure where to start, there are many budget templates available online. Youll need to create a budget template or use an existing one. The first step in creating a budget is to set up your budget. Well walk you through each step of the process, from setting up your budget to tracking your spending. In this article, well show you how to make a budget in Google Sheets. You can use a pen and paper, a spreadsheet, or a budgeting app. There are many different ways to make a budget. Making a budget is one of the most important things you can do to get your finances in order.

0 kommentar(er)

0 kommentar(er)